Biden’s Crucial Verdict on U.S. Steel’s Japanese Acquisition

- President Biden is set to decide on the proposed $15 billion acquisition of U.S. Steel by Japan’s Nippon Steel.

- The deal has been met with skepticism due to potential national security risks and concerns about job preservation.

- Despite concerns, both companies have launched a PR campaign, arguing the deal will strengthen the American steel industry.

- The decision could have far-reaching implications for the global steel industry and future foreign acquisitions of American companies.

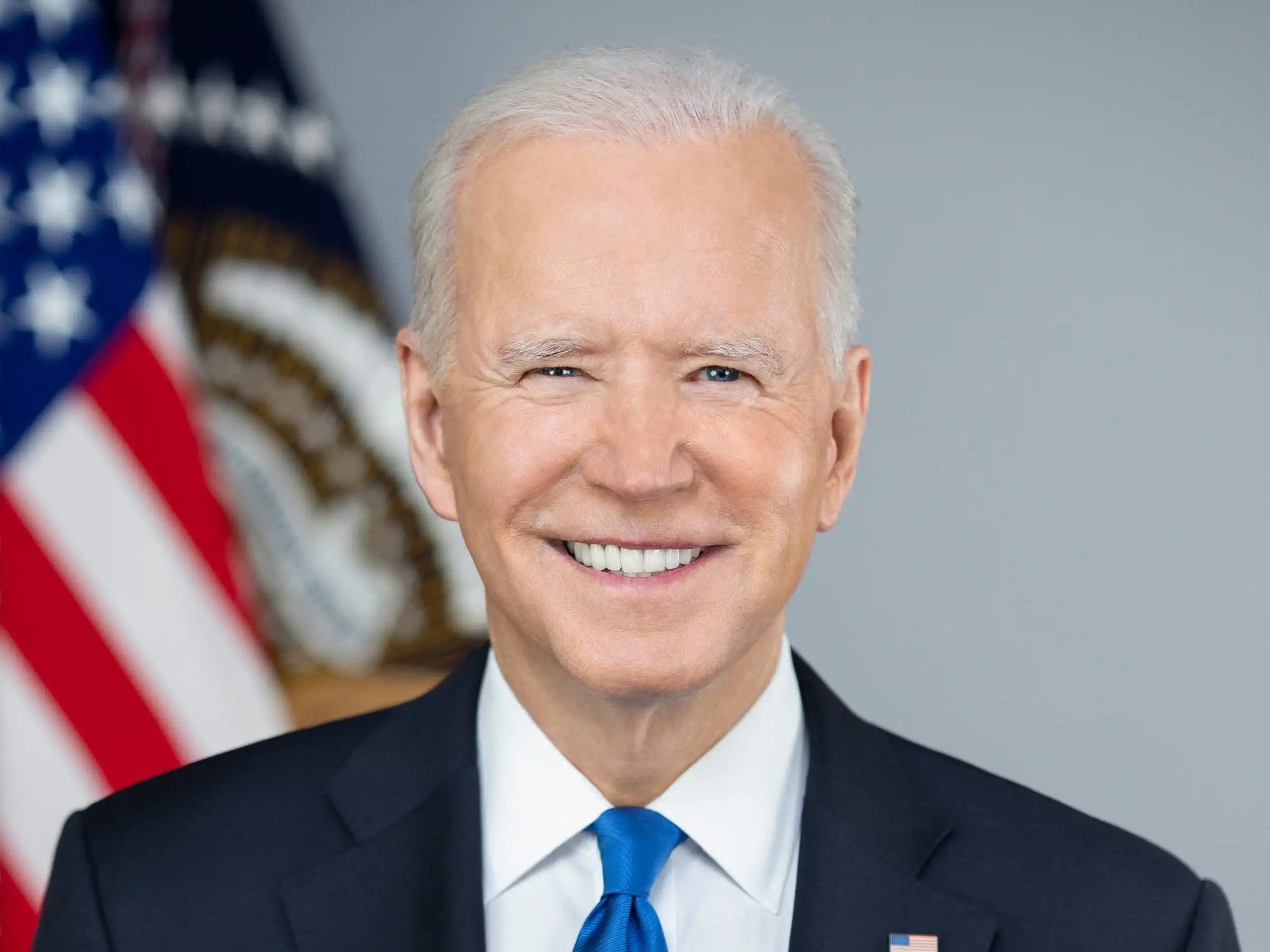

The global steel industry is on the brink of a significant shift as President Joe Biden is set to decide on the proposed acquisition of U.S. Steel by Japan’s Nippon Steel. The decision comes after the Committee on Foreign Investment in the United States (CFIUS) failed to reach a consensus on the potential national security risks of the nearly $15 billion deal. The proposed acquisition has been a contentious issue, with both Biden and President-elect Donald Trump expressing opposition due to concerns about foreign ownership of a flagship American company.

The economic risk, however, lies in potentially forfeiting Nippon Steel’s potential investments in the mills and upgrades that could help preserve steel production within the United States. Under the proposed $14.9 billion all-cash deal, U.S. Steel would retain its name and its headquarters in Pittsburgh, where it was founded in 1901 by J.P. Morgan and Andrew Carnegie. It would become a subsidiary of Nippon Steel, and the combined company would be among the top three steelmakers in the world, according to 2023 figures from the World Steel Association.

The deal has been met with skepticism from some federal agencies represented on the CFIUS panel, who question whether allowing a Japanese company to buy an American-owned steelmaker would create national security risks. The steelworkers union has also raised concerns about whether Nippon Steel would maintain jobs at unionized plants, honor collectively bargained benefits, or protect American steel production from cheap foreign imports.

Public Relations Campaign and Political Support

Despite these concerns, Nippon Steel and U.S. Steel have launched a public relations campaign to win over skeptics. U.S. Steel stated that the deal “is the best way, by far, to ensure that U.S. Steel, including its employees, communities, and customers, will thrive well into the future.” Nippon Steel, on the other hand, urged President Biden to consider the significant commitments they have made to grow U.S. Steel, protect American jobs, and strengthen the American steel industry, which they argue will enhance American national security.

The proposed acquisition comes at a time of renewed political support for rebuilding America’s manufacturing sector and a long stretch of protectionist U.S. tariffs that analysts say has helped reinvigorate domestic steel. The deal also coincides with a presidential campaign in which Pennsylvania, a state with significant steel industry presence, was a prime battleground.

The CFIUS, chaired by Treasury Secretary Janet Yellen, screens business deals between U.S. firms and foreign investors and can block sales or force parties to change the terms of an agreement to protect national security. Its powers were significantly expanded through the 2018 Foreign Investment Risk Review Modernization Act, known as FIRRMA.

Historical Significance and Industry Implications

In September, Biden issued an executive order broadening the factors the committee should consider when reviewing deals — such as how they impact the U.S. supply chain or if they put Americans’ personal data at risk. This move could potentially influence the final decision on the U.S. Steel-Nippon Steel deal.

The proposed acquisition has historical significance as it recalls previous instances of foreign companies acquiring American firms, which have often sparked debates about national security and economic sovereignty. For instance, in 2020, Beijing Kunlun, a Chinese mobile video game company, agreed to sell gay dating app Grindr after receiving an order from CFIUS.

The U.S. Steel-Nippon Steel deal also comes amid a wave of consolidation in the steel industry, fueled by soaring prices. Steel prices more than quadrupled near the start of the pandemic to near $2,000 per metric ton by the summer of 2021 as supply chains experienced gridlock, a symptom of surging demand for goods and the lack of anticipation of that demand.

The outcome of this deal could have far-reaching implications for the global steel industry and the future of U.S. manufacturing. As the world watches, the decision now rests with President Biden, who has 15 days to make a final call. This decision will not only shape the future of these two companies but could also set a precedent for future foreign acquisitions of American companies.

Post Comment